Summary

The deadline for making a 2022 IRA Contribution is April 18, 2023. Please note, Emancipation Day in the District of Columbia (DC) will be celebrated on April 17th this year. As a result, April 17th is a holiday for federal government offices in DC and extends the tax filing deadline one business day to April 18th.

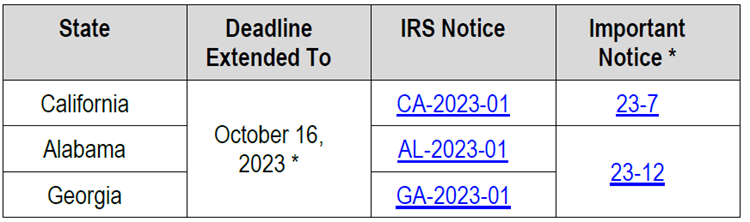

NOTE: The IRS has provided tax relief for residents of the following states due to various storms or natural disasters.

Check Processing Guidelines

To ensure Prior Year Contribution (PYC) checks are in good order and meet the 2022 contribution deadline:

- The postmark on the original envelope must be on or before April 18, 2023

- USPS metered mail stamps, if present, must be dated on or before April 18, 2023

- For overnight mail: obtain a receipt from the overnight carrier showing:

- Delivery Information

- Date sent to ESI for processing

- For checks hand-delivered to your office, maintain evidence that they were mailed by your firm to NFS on or before April 18, 2023

- Avoid the use of prepaid business reply envelopes, as these do not provide proof of the mail date.

Mobile Check Deposit

The NFS process to code checks received after April 18th can be extremely cumbersome. Our Operations team receives this feedback every year after tax deadline.To avoid this frustration, do not mail checks to ESI Home Office for processing. Checks can be deposited via mobile deposit by the client via the Wealthscape Investor App, or by the Registered Representative/Admin Support staff via the Wealthscape App.

Important Notes

- PYC checks received after April 18, 2023, will not be processed without proof that they were mailed on or before April 18th.

- Checks deposited after April 21, 2023, must be booked as Current Year Contributions (CYC). If the check was intended as a PYC, ESI must submit the following documentation to NFS to modify the tax year:

- Envelope in which the IRA contribution check was received. The postmark must be visible and be dated on or before April 18, 2023. Keep the envelope for firm records.

- Copy of the IRA Contribution check along with accompanying documentation from the customer clearly indicating the intended tax year. This documentation can be in the form of a memo on the original check, or an attached letter of instruction.

- Letter of instruction from customer must include check amount, date, account number and

intended tax year.

- Provided the request if properly documented, NFS will adjust the deposit made by ESI from a CYC to PYC, which in turn will automatically update the tax records for the impacted tax years.

Deadlines by Contribution Method

| Electronic Funds Transfer (EFT) | Loaded to ICP by April 18, 2023, 11:59pm ET |

| Bank Wire | April 18, 2023, 6:00pm ET |

| Journal from Non-Retirement Acct | Loaded and approved by ESI by April 12, 2023, 11:59pm ET |

Postponed Contributions Due to IRS Tax Relief

2022 IRA Contributions received after April 18th and are eligible for an IRS-granted tax filing extension relief must be processed as a CYC. The IRS requires contributions made after the federal tax filing deadline to be reported in Boxes 13a, 13b, and 13c of IRS Form 5498 as “postponed/late” contributions.

To adjust a contribution to report as postponed, please contact the Brokerage Operations department and provide verbal instructions.

Questions

If you have questions regarding the process for depositing Prior Year Contributions, please contact the Brokerage Operations desk at 1-800-344-7437.

TC132706(0423)1