From Touchstone Investments:

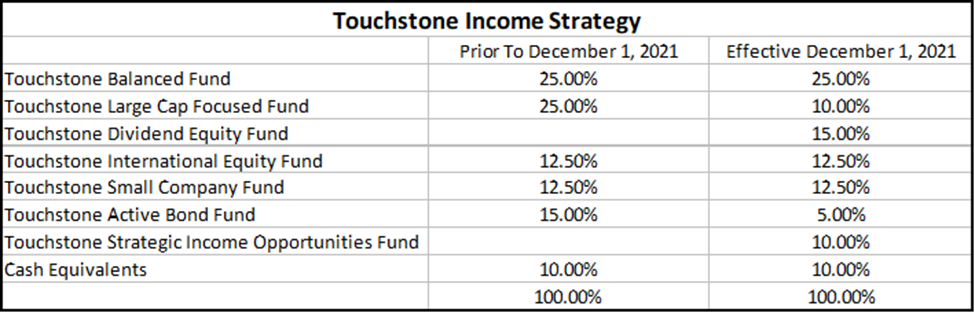

Modest changes were made to the Touchstone Income Strategy through the addition of two mutual fund investments. These funds should enhance the Income Strategy’s potential to generate additional income and capital appreciation while maintaining a focus on downside protection through increased diversification. Both investments employ established strategies with compelling long-term track records supported by deeply experienced teams. Highlights of both strategies are below. For more information on the Touchstone Income Strategy, view the updated marketing and training materials on the ESI Illuminations platform.

- Touchstone Dividend Equity Fund seeks current income and capital appreciation by investing in equity securities of U.S. large-cap companies that have historically paid dividends. The Sub-Advisor believes the unique approach results in a portfolio of high quality companies with sustainable competitive advantages that should pay reliable, growing dividends at reasonable valuations.

- Touchstone Strategic Income Opportunities Fund seeks a high level of current income with a focus on capital preservation by investing in income producing fixed income securities. The Fund’s sub-advisor employs a high conviction, yield-oriented investment approach with a relatively focused number of issuers, coupled with sector diversification and diligent risk management.

TC124523(1221)1