NFS Client Statement Enhancements

Effective 10/30

Beginning in October, ESI Brokerage Account customers will begin receiving a NEW enhanced statement format! The new statement format will apply to all Monthly/Quarterly and Annual statements for NFS Brokerage and ESI Illuminations accounts.

The enhancement corresponds closely to the roll-out of the quarterly paper statement surcharge. This may be a good opportunity to reach out to customers, explain the improved formatting of their statements and encourage them to enroll for eDelivery to review online at the Wealthscape Investor portal.

What’s changing?

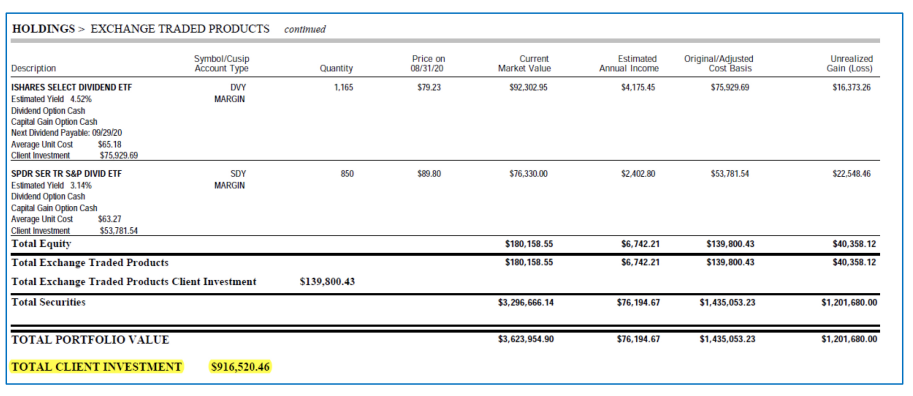

The holdings section is being enhanced to display client investment and a new disclosure, when applicable. Client investment will represent the sum of the purchases made for a given security where purchases are defined as Buys, Transfers and Conversions. Please note, transfers and/or conversions must have customer or third-party provided basis.

Enhancements include the following:

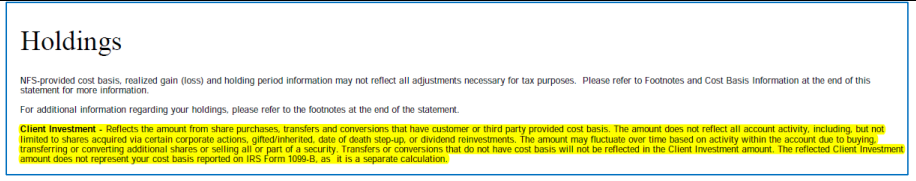

• A new disclosure will appear at the beginning of the holdings section and will include the definition of client investment.

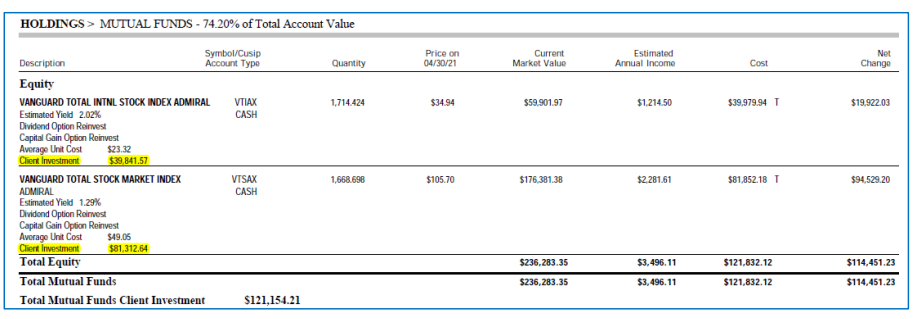

• Client investment amount will display within the security description if it meets the definition criteria above.

• The client investment information will not display if the definition criteria is not met.

• Sub-total for each major asset class will display the sum of client investment for each security within that holdings sub-section.

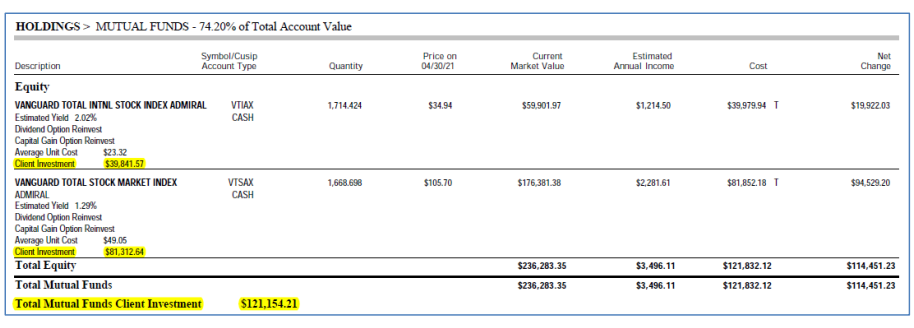

• Overall total for client investment will display at the end of the holdings section.

Screenshots of Changes highlighted in yellow

- Holdings: Proximity Disclosure for Client Investment – Client investment Disclosure is in holdings section which provides the definition of “client investment”

- Holdings: Client Investment at the Holdings Level – Client investment will be available in Holdings for each position within the description column.

- Holdings Sub-Categories: Overall Client Investment Totals by Sub-Category – Client investment totals at the sub-category level are being provided where applicable.

- Holdings: Overall Client Investment Total – Overall client investments total for the holdings section is being provided where applicable.

Automated Wealthscape RMD Report

Throughout the last quarter of 2021, ESI Operations will deliver an automated reporting alert to your NL email address to assist in managing RMD’s for your NFS Brokerage account customers.

On or around the 15th of each month during Q4 the report will be triggered. The automated email contains a hyperlink that will launch the report if you are logged into Wealthscape. If you are not logged in, you will be asked to enter your credentials.

The report has been filtered to show accounts with an “estimated RMD amount remaining” of greater than zero. This will NOT show clients who have already satisfied their RMD for a specific account this year. The report also contains an indicator that shows whether the customer has a periodic plan set up on the account, and the remaining amount scheduled to pay as part of the plan.

Please proactively raise cash for the periodic plans if cash is not currently available. Failure to do so could cause the plan to fail and expose the client to potential penalties on amounts that were not distributed by the 12/31 deadline.

Please contact our service desk at 1-800-344-7437 with any questions.

TC123624(1021)1