Changes Effective as of 12/20/21

For ERISA fiduciaries selling insurance products in IRAs, compliance with Prohibited Transaction Exemption (PTE) 84-24 requires that you disclose your compensation, as well as the insurance contract’s fees and expenses, to the owner of the IRA pre-transaction. The disclosures must be made in writing, and the client must acknowledge them by signature.

To comply with these requirements, ESI has rolled out the “84-24 Qualified Annuity Disclosure” form for use with any annuity purchase in a qualified account regardless of the funding source. Because disclosure is required before the transaction, if this form is not received with the new business paperwork, ESI will be unable to process the business.

For help with how to complete the form, ESI has created:

- Variable Annuity Commission Schedule

- Fixed Indexed Annuity Commission Schedule

- Video training – step by step how to complete the 84-24 Qualified Annuity Disclosure Form

- Field Notice 2021-34: PTE 84-24 Disclosure Form

Important Notes

- If you have a qualified rollover case that has been created in Docupace but not yet signed prior to 12/20/21, the new PTE 84-24 Qualified Annuity Disclosure (form number ES0737) may not have been included. If so, you’ll need to pull the new form from the Docupace library and include it in your case.

- The new PTE 84-24 Qualified Annuity Disclosure (form number ES0737) will replace current rollover forms that were in the qualified annuity Docupace kit. The rollover forms will no longer be applicable to annuity business, but will continue to be used for non-annuity business.

- As always, any outdated printed or saved forms should be discarded to avoid causing delays in business processing.

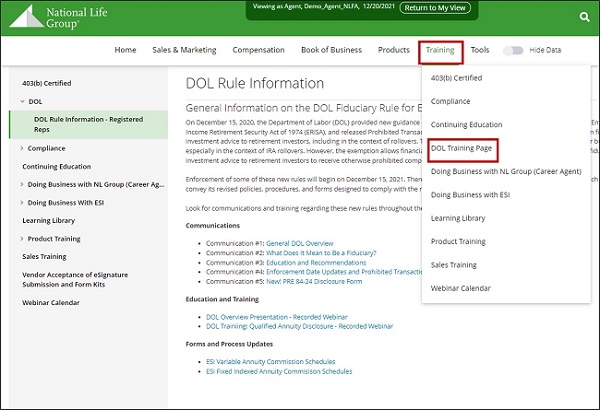

To review any of the DOL communications or resources, please see the DOL page on the NL agent portal.

TC124739(1221)1